Topic: Income Investing

Apr. 7 2016, 09:52 AM ET - by VF member

cancerfixer (1096  )

)

Introducing the RIP Survivor Portfolio

RIP = Retire In Peace

On February 20, in a moment of frustration, I wrote an off-the-cuff post about Investing vs Trading on Value Forum (

https://www.valueforum.com/forums/show.mpl?keywords=1456015433.40.99&so=201602). It must have struck a nerve, because it got a lot of thumbs & Jonsventnor interviewed me about it at InvestFest. Afterward I promised to follow up on a couple of things. This post will summarize a few points and kick off a series of posts about how to deal with the issue.

Summary of the problem:

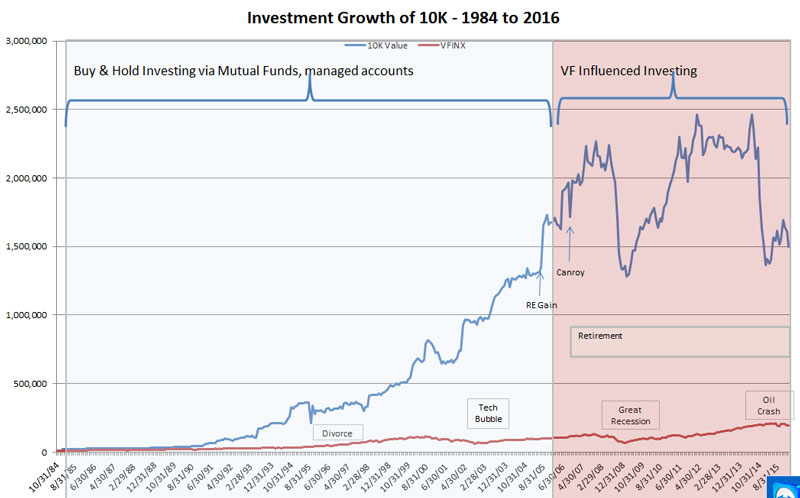

If your investment focus is income, VF may not be your friend. Below here is an expanded view of my net worth growth of 10k curve between 1984 and this year. The chart should be self-explanatory, but I’ll spell out the obvious anyway.

The red line at the bottom is the div adjusted growth of VFINX since 1984. The blue line is my net worth. (I’d like to take credit for what looks like incredible growth – but the net worth line has not been corrected for my annual W2 income, which distorts the curve considerably). My first W2 income was in 1974 and my self-employed income started in 1979. During my work/accumulation years my net worth gradually increased at a steady pace. I was too busy to pay attention to investments and just dumped money into various randomly selected mutual funds. Growth was slow, but smooth & steady.

Shortly before retirement (2007), I started to pay more attention to investing. It started with the Yahoo! SJT board and migrated to VF. Most investments since then have been highly influenced by VF posts and VF favorites.

The difference between pre-retirement (inattentive passive investing) in the blue area and retirement (VF influenced active investing) in the pink area is clear: dramatically increased volatility with both increased gains and losses. Even the

partial list of risky investments is long: Canroys, Absolute Software, SDT, LINN, LNCO, EMES, MHR, FRO, SDRL, Awilco, NADL, AMBA, and so forth. I made and lost a lot of money on most of these tickers.

The reason, in my opinion, is that

trading, which happens on a daily basis, generates far more posts than buy/hold income investing. Constant exposure to frequent trading posts temps less experienced investors, such as me, to take more risks. This can lead to outsize gains, but also outsize losses as limited skill & experience, poorly defined strategy, and inadequate discipline takes its toll.

Now don’t get me wrong. There is nothing wrong with trading if you work hard at it, have the knowledge, skill, discipline and strategy to trade. I happen to like reading about what the traders are doing & do get some good ideas from them. The problem is that, in my opinion, most VF members, me included, lack one or more of those characteristics. Even without those characteristics, I do like to trade on occasion. I really like to play with short puts and calls, as taught by dig4value. I love to watch ITG’s trades & marvel at his skill. I even like to take “fliers” on long shots such as GBT, ARTH & ESPR (which, BTW, will surely make me rich beyond my wildest dreams very soon). But, in my opinion, trading should not be the focus of a retiree portfolio aimed at income. And trading is certainly not compatible with a survivor portfolio. How in the heck is your spouse supposed to deal with those positions when you are gone?

I’ve struggled publicly with this problem in several VF posts over the last few years and come to the conclusion that someone with poor discipline, wandering interests and unfocused strategy should not be trading the VF stock-of-the-week. OK, so what’s an income-focused investor to do? Here’s the secret: Value Forum can be both your worst enemy AND your best friend. As it turns out, there are posts here that can lead you to success. They aren’t as frequent as trading posts, but they are here. You just have to pay attention to the right things and adopt a different attitude. With minimal work it’s even possible to come up with a survivor friendly investment strategy.

VF posts by honkytonker (“Fraidy Cat Portfolio”) and AverageDow (“Almost Boring Portfolio”) and others are great places to start. If you look into these, you’ll see they are staying away from the volatile stuff for the most part. Most holdings are aimed at income and there is not a lot of trading.

There are certainly other ways to skin this cat. You can look at posts about “Lazy/Permanent/Couch Potato” portfolios, professional portfolio management services, indexing baskets, Life Strategy Funds, and robo-advisers. I had already rejected most of these ideas based on relevant posts and my own research and experience. I came up with another strategy that, it turns out, is not only good for retirement income, but can also be adopted for a survivor portfolio (ie so your heirs don’t have to scramble to salvage investment assets as soon as you are cold).

So here is where VF became my new best friend: Unbeknownst to me, VF had already been steering me into this strategy for the last year or two. It was only in the last few weeks that I realized this was an actual strategy that could be written down so others could do the same thing. The first clue arrived in the form of a 2/21 Shri post replying to my own post about trading vs investing (

https://www.valueforum.com/forums/show.mpl?keywords=1456079080.24.32&so=201602). In that post he suggested we look at this book by Bruce Miller: “Retirement Investing for Income ONLY” (

http://www.amazon.com/Retirement-Investing-Income-ONLY-Dividends-ebook/dp/B00O28ELH4). So I bought the ebook ($4.49) and started to read. It’s self-published and has the usual flaws of that medium, but it struck a chord. Basically, he advocates a strategy that picks individual portfolio positions based on long term dividend paying stocks with a long term history of increasing dividends. The best part is that he shows readers a simple way to analyze company financial reports to tell whether they are likely to continue increasing dividends in the future. For the first time the gibberish on financial statements started to make sense to me. I realized they can actually hint at the future. (I’ll review the book and detail the methodology in a later post)

The next clue arrived in the form of a 3/9 post by strange1 (

https://www.valueforum.com/forums/show.mpl?keywords=1457552735.54.11&so=201603). He posted the text of this article:

(

http://www.talkmarkets.com/content/us-markets/the-10-best-dividend-stocks-for-retirement?post=88037). Again, an interesting read. It noted the outsized performance of 10 stocks that are essentially dividend aristocrats (ADM, FLO, ED, SCG, T, VZ, CMI, EMR, JCI, SO). It did not escape me that the article described the end result of Bruce Miller’s strategy. Out of curiosity, I plugged those tickers into my back-test spreadsheet & saw a 2000 to 2016 curve that made the impressive TAA results shown at InvestFest look anemic. Of course, you can’t do that realistically – it’s called data mining and will always produce ridiculously outsized returns. Impressive, nevertheless.

And then on Monday, this article appeared in the WSJ:

http://www.wsj.com/articles/federated-strategic-value-is-no-1-fund-1459735515. It described how the top 2 mutual funds in the WSJ quarterly contest (SVAAX & IDIVX) were both focused on long term dividend paying stocks – the same strategy put forward in Bruce Miller’s book.

OK. I’m data mining stuff that supports my thesis. I admit it. Stick with me here….

This is all very good for an investment strategy – but how can this become a

survivor strategy? The first step is to realize that

you cannot invest from the grave. The best you can do is help your heirs get to a soft landing. So, by combining this approach with other features, it should be possible to make your nest egg stable for at least a year or two after you are gone. If your inexperienced survivors have established a good relationship with a competent investment manager, they should be able to adapt the portfolio into the new reality, despite their disinterest. At the very least they should not have to scramble to stop losses while shoveling dirt over you.

I’m not going to claim I have THE answer because what I am doing applies to ME and suits my needs. I am retired with a nest egg sufficient to support me on dividends & interest alone without withdrawals until I am over 90. This approach might even work with a smaller nest egg. Here is my approach:

Summary of cancerfixer’s RIP (Retire In Peace) Survivor Portfolio:

The RIP Portfolio strategy rules:

1) Invest for retirement income only - adequate to pay the bills

.....a. Almost entirely in Dividend & Interest investments

.....b. Focus on ETFs, OEFs or CEFs to minimize company risk

.....c. Occasional and rare single company stocks with a long history of dividends & dividend increases (analyzed using Bruce Miller’s methods)

.....d. Diversify holdings between industries (the 10 std ones) and classes (pfd, stock, bonds) to reduce risk

2)

Stay away from the VF favorite Stock-of-the-month (with rare exceptions). This rule is perhaps the most difficult. This requires unusually strong will power.

If it does not fit rule 1) above, just say NO!

3) Buy & HOLD. Strongly resist the temptation to sell on pullbacks. If the fund or stock is good, it will always come back. All you care about is whether your income stream is safe. The “sell if it drops 7%” rule is not your friend!

4) To turn this into a Survivor Portfolio, and if there is money left over after the income portion is invested, put the remainder into a managed account (using a TAA or another strategy of choice) with qualified, compatible fee-only RIA/trade administrator familiar with the estate plan and able to step in and assume portfolio management when you die.

5) Optional: Rare Option & flier investments for entertainment & occasional profit – but

only if there are sufficient assets significantly above & beyond investments generating income. This is only here because VFers are self-directed and unable to be idle.

Many here will probably disagree with at least one or more of the rules – but this strategy is not meant for them. It’s meant for my situation. We’ll just have to agree to disagree, especially about the buy & hold and 7% loss rules. If your situation is similar to mine, you are welcome to jump aboard this train.

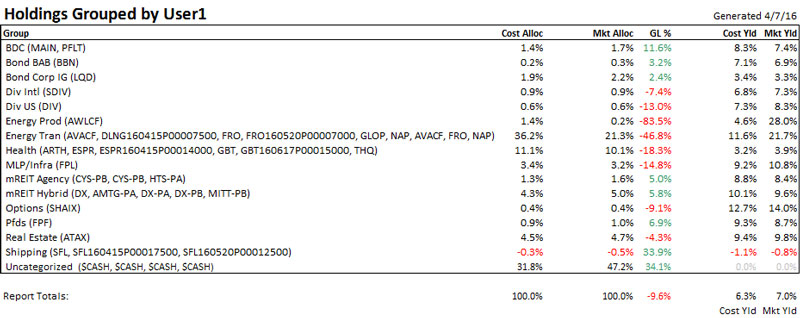

Here are my current holdings in the accounts using this strategy. Other accounts are not shown. The current cash position is 47.2%. The TAA portion is currently in cash. I consider both energy groups to be legacy holdings slated for liquidation and replacement with more appropriate holdings consistent with the new strategy. There are some speculative fliers in there (GBT, ESPR, ARTH) and option plays. In the future I’ll adjust the report leave out options. Preferreds are split between 3 groups. REITs are all in Roth accounts except DX (If you had been at InvestFest, you would know that most, if not all, of DX dividends will be tax free in 2016 because of extensive tax loss carry-forwards. See – you shoulda gone to InvestFest!). The current distributions should cover my living expenses adequately. Coverage will be even better once the legacy holdings are invested more appropriately.

Let the comments begin. I will follow up with a post describing Bruce Miller’s book and strategy in the future.

cancerfixer